News

Unretirement Because of Politics?

by Jitesh Gandhi on May.15, 2013, under Politics, Site News

Well, not really. I haven’t blogged in a while and there are a lot of reasons for it. Probably the biggest being the amount of effort it takes to write. Which is closely related to #2, which is the amount of time that I want to devote to things I want to blog about is high. And that leads to #3. Far more people have thoughts on topics that I want to blog about by the time I can get to it, it feels like I’m rehashing their thoughts. I considered tweeting to get my thoughts “out there” more quickly, but it’s just not the medium for those thoughts.

So what got me to write a post over 2 years after my last one? John Boehner.

My question is, who’s going to jail over this scandal?

— John Boehner on the IRS Scandal

A line was crossed by the IRS, no question, but sending someone to jail when not one person was even prosecuted over the 2008 financial crisis? Beyond ridiculous.

And he’s not the only person in Congress demanding this. This is how dysfunctional Congress is at this point. Imagine if both parties could be this enraged over far bigger problems?

Using TV Shows to Determine Political Leaning

by Jitesh Gandhi on Dec.29, 2010, under Entertainment, News, TV

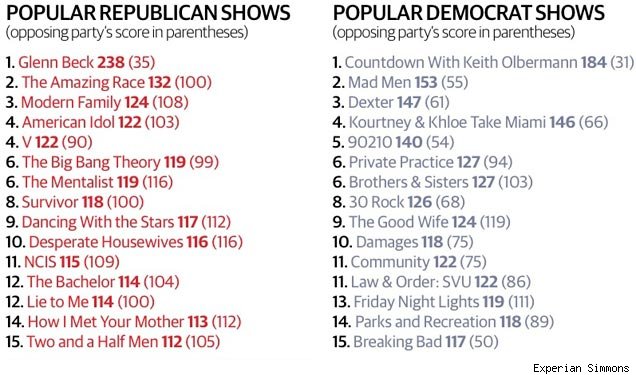

I saw a study was released last month about the TV shows that Democrats and Republicans find most popular. So I took a look at the top 15 shows on both sides and checked what I watch on the list.

The final tally:

Popular Republican Shows:

Popular Democrat Shows:

2. Mad Men

3. Dexter

5. 90210

6. Brothers & Sisters

8. 30 Rock

9. The Good Wife

10. Damages

13. Friday Night Lights

14. Parks and Recreation

15. Breaking Bad

I also stopped watching How I Met Your Mother (#14, Republican) and am on the verge of dumping Community (#11, Democrat).

So does that make me a left-leaning independent? (It would match how I view myself, fiscally conservative, socially liberal.)

Do the shows you watch match your political leanings?

Cell Phones in Prison, Step Away From Strip Searches to Fly

by Jitesh Gandhi on Dec.05, 2010, under News

I’d file this under not making much sense. I read an article about cell phones in California prisons after Charles Manson was caught with one in 2009. I’d like to know how people are able to smuggle cell phones into prison to give to murderers. How do they charge the cell phones? Do they also smuggle in chargers? Do they have Wi-Fi in prison so that they can save their minutes and use FaceTime on their iPhones? Who is paying the bills and/or adding minutes to pre-paid cell phones?

At the same time, there are so many stories about the ridiculousness of the TSA. the rest of us non-felons can’t bring more than 100 mL of fluid in a single bottle past airport security. And actually, we can’t bring 1 mL of fluid in a bottle larger than 100 mL past security. It looks like California needs to hire the TSA to secure their prisons.

Apple Response to iTunes/App Store Hack Seems Dubious

by Jitesh Gandhi on Jul.07, 2010, under News, Technology

Over the long weekend, there were reports that iTunes accounts were hacked and fraudulent purchases were made in iTunes and the App Store. Most notorious was a single author having a lot of his books in the top 50 in iBooks. Yesterday, Apple responded with the following:

The developer Thuat Nguyen and his apps were removed from the App Store for violating the developer Program License Agreement, including fraudulent purchase patterns.

Developers do not receive any iTunes confidential customer data when an app is downloaded.

Engadget also reported that roughly 400 iTunes users were affected by this. To me, all of this does not make sense. I still have questions, and as far as I can tell, the press has taken Apple’s word and moved on to other things.

- How was a developer able to make fraudulent purchases on other users’ behalf?

- Is Apple implying that Apps this developer made were able to do this? If so, what have they done to prevent other developers from doing the same thing? Have they issued a remote kill on his Apps? This would seem to be a very big security issue. (Also, some of the people who reported the fraudulent activity claimed they never purchased anything from that developer).

- If they aren’t implying that, what other mechanism was used by this developer?

- Apple’s own PR says that over 1.5M books were downloaded in the first 28 days. Since then, over 2M more iPads were sold. It took only 400 iTunes accounts to push 42 books into the Top 50? On the surface, it seems like a very low number of books (assume 400 copies of each) to take over the Top 50. Are sales for popular books that low?

I hope people out there are doing some more digging on this and not just taking Apple’s statement as the full story.

Let’s Sue Apple!

by Jitesh Gandhi on Jul.02, 2010, under News

I just read about the filing of a lawsuit against Apple over their iPhone 4 antenna/reception problems. It turns out, this is the fourth lawsuit filed over the barely week old iPhone. I imagine Apple’s response would be a copy of their return policy:

If you are not satisfied with your iPhone purchase, please visit online Order Status or call 1-800-676-2775 to request a return. The iPhone must be returned to our warehouse within 30 calendar days from shipment to avoid an $175 early termination fee. The iPhone must be returned in the original packaging, including any accessories, manuals, and documentation.

They also said in the case of the iPhone 4 they would give a full refund (they normally have a 10% restocking fee).

Plaintiff seeks actual and/or compensatory damages; restitution; equitable relief, including the replacement and/or recall of the defective iPhone4; costs and expenses of litigation, including attorneys’ fees; and all additional and further relief that may be available. Plaintiff reserves the right to amend his Complaint to add additional relief as permitted under the CLRA or other applicable law.

How much damage can there be in a week? Especially when you can return your phone (your contract is also canceled). I’m far from an Apple apologist, but this just seems like people wanting their 15 minutes.

It’s Called the Referer!

by Jitesh Gandhi on May.22, 2010, under News, Technology

Yesterday, the Wall Street Journal published a story about a “Privacy Loophole” in many social sites. I’m not sure if they just wanted to pile onto the the whole privacy fire or if they really don’t quite understand what it is.

The bottom line is this is nothing new. It’s called the Referer (I do know this is spelled wrong, but somehow this is how it was spelled in the actual standard) and it is very simple. It is part of the standard that is essentially the basis of the “world wide web”. When you click a link, part of the information that is sent to the site that link points to is the address of the page where the link originated. So when anyone clicks the link to the WSJ article in the previous paragraph, the people at the WSJ will know how you arrived at that article.

This is how I know ~75% of the traffic to my site is from Google searches. So, if I’m on my Facebook homepage (http://www.facebook.com/jhgandhi) and I click an advertisement (it has to be a direct link to the advertiser’s site) they will know where I came from and could visit my facebook page (of course, they’d have to be my friend to see more than basic information).

The simple solution (which Facebook and MySpace implemented quickly) is to just have the ads link to a page on their own site that then redirects to the advertisement’s site.

This “loophole” is everywhere a page with personally identifiable information links to another page. It has been around since 1990. Other information a web site gets includes your IP Address (can be used to get a rough location), what Operating System (Type and Version) you are running, what your screen resolution is, what fonts are installed on your machine, what browser you are using and a bunch of other things. This site has a good summary of what it can capture when you visit their site (this site will read all of the information that you transmit and display it to you).

It is good that they published the article, but it comes across as somewhat sensational when it is something very common all over the web. It likely took only a few minutes for them to make the changes to their ads so that the potential for people to use the referer is eliminated. So remember, when you click a link from my blog, wherever it takes you, they could find out you read my blog. :)

Stock Market Plunges, Investigations Next

by Jitesh Gandhi on May.06, 2010, under Investing, News

The big news today was the 1000 point drop of the Dow. Early blame is being placed on a bad order for Proctor & Gamble stock. So that makes sense. If a bad order for P&G is executed it’s one of 30 stocks that make up the Dow Jones Industrial Average, so it would send it down a fair amount. But that doesn’t explain all the other stocks dropping.

At 2:45 PM. the DJIA moved from 10,236 to 9,872 (fell 3.6%) )and back to 10,203 (gained 3.4%) in 5 minutes. The NASDAQ, which has over 3,000 components fell 2.6% and gained 2.7% in the same period. The Russell 2000 fell 2.3% and gained 2.7%. Lastly, the S&P 500 fell 1.7% and gained 3.5%.

So it wasn’t just one stock, it was the entire market as a whole that had a very quick drop and a subsequently quick recovery. I believe that the only way that the markets could move that fast and that much is through computerized trading. There was not a massive sell off by humans placing sell (or short) orders.

Instead, the primary culprit was High Frequency Trading and Flash Trading followed by automated trading and the triggering of stop-loss orders. I think it is this last thing that is going to have human investors very upset.

To put it simply, investors will place a stop-loss order to try and limit their losses. What happens is an investor will buy a stock like Apple at $250/share. They will then place a stop-loss order at say $220 to limit their losses to roughly $30/share. The problem here is that computers caused an artificial and drastic move downwards by mostly trading amongst themselves that pushed Apple down below $200. So the investor had their stock sold at $220 as Apple plunged because of this fiasco. Then the market quickly corrected and Apple was back to $246 (and really was under $220 for less than 5 minutes. The investor has lost over $26/share and Apple stock went back to a proper price.

Congress has already been talking about financial reform and tomorrow, and maybe over the next week, they will be pointing to this event as another reason it is so badly needed. This won’t end at a bad trade.

Facebook

Facebook LinkedIn

LinkedIn